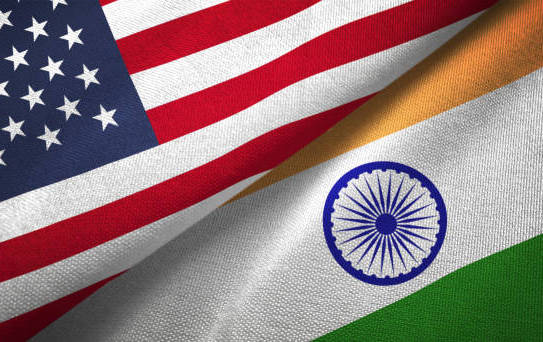

As the president of the United States, Donald Trump, approaches the critical date of April 2 for implementing reciprocal tariffs on imports, a palpable tension reverberates through the international business landscape. The global trade ecosystem finds itself at a pivotal moment, with national responses ranging from aggressive counter-tariff strategies to pragmatic diplomatic negotiations. India’s approach, in particular, stands out for its measured and strategic deliberation.

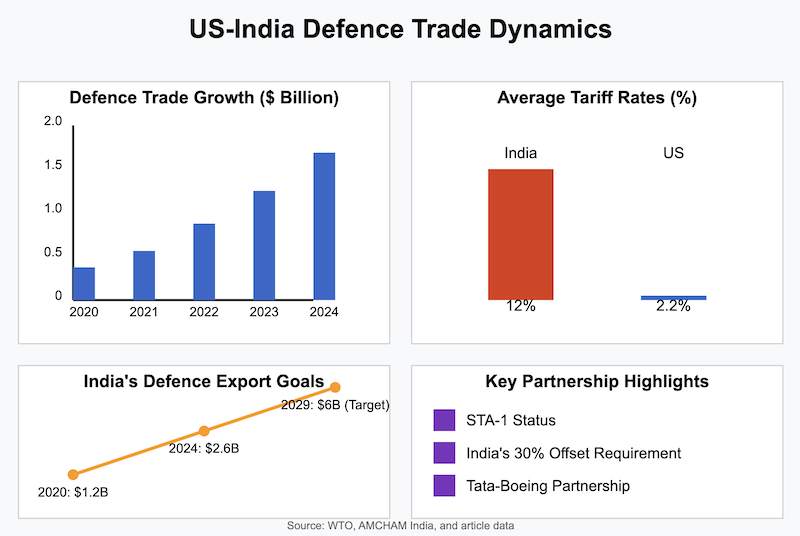

The intricate economic arithmetic reveals a nuanced trade relationship. World Trade Organization (WTO) data highlights that the US currently imposes a weighted average tariff of merely 2.2% on Indian goods, while India maintains a 12% tariff on American products. Despite this disparity, the bilateral trade partnership remains robust, with goods trade exceeding $120 billion in 2024.

The defence sector emerges as a particularly compelling narrative in this bilateral relationship. According to the American Chamber of Commerce in India (AMCHAM India), defence trade between the two nations has surpassed $2.8 billion over the past five years, demonstrating a rapidly evolving and multifaceted partnership.

Real also: National security and India-US convergence

The US has strategically positioned itself as both a supplier and purchaser in these defence transactions, symbolized by the unprecedented STA-1 (Strategic Trade Authorization) status conferred upon India – a designation traditionally reserved for the closest allies.

This status enables India to import advanced defence equipment and exclusive dual-use technologies. Simultaneously, US defence companies are astutely aligning with India’s defence procurement policy, particularly its critical offset requirements. These requirements mandate foreign suppliers to collaborate with local firms, establishing manufacturing facilities for essential defence system components and subsystems that are subsequently distributed globally.

The offset clause, a fundamental component of India’s Defence Procurement Procedure 2005, requires foreign defence equipment suppliers to invest 30% of contract values exceeding ₹2,000 crore in the local defence industry. This approach aims to enhance manufacturing capabilities, generate employment, and cultivate a dynamic industrial ecosystem.

Exemplary illustrations of this collaborative approach include Boeing’s strategic partnership with Tata Group, forming Tata Boeing Aerospace Limited. This joint venture focuses on producing helicopter components for global clients, including the United States. Similarly, other companies, like Lockheed Martin, are actively engaging in defence-related manufacturing within India for international markets.

India’s ambitious defence export goals, strongly supported by the Make in India programme, have yielded impressive results. In 2024, defence exports reached $2.6 billion, with a governmental target of $6 billion by 2029. The US remains a crucial partner in this strategic vision.

However, the potential implementation of tariffs introduces a layer of complexity. India’s exports to the US predominantly comprise subsystems, aircraft components, artillery system parts, small arms, and electronic goods. Industry experts warn that increased tariffs could potentially escalate costs for US buyers and reduce their competitive edge, discourage manufacturers with international facilities from sourcing products from India, or even disrupt the carefully cultivated defence-manufacturing ecosystem in a major way.

Read also: India’s foreign-aid strategy to counter China’s expanding footprint

While commercial considerations are significant, the defence trade landscape transcends mere economic calculations. Geopolitical dynamics and strategic national interests play pivotal roles in shaping these partnerships.

As negotiations continue, the future of US-India trade relations hangs in a delicate balance. The potential tariffs represent not just an economic challenge but a critical test of diplomatic and strategic collaboration between two of the world’s most significant democratic economies.

Disclaimer: The views expressed in the article are the author’s own and don’t necessarily reflect the views of India Sentinels.

Follow us on social media for quick updates, new photos, videos, and more.

X: https://x.com/indiasentinels

Facebook: https://facebook.com/indiasentinels

Instagram: https://instagram.com/indiasentinels

YouTube: https://youtube.com/indiasentinels

© India Sentinels 2024-25